A Bit About Executive Orders

03.27.2025 | Linda J. Rosenthal, JD

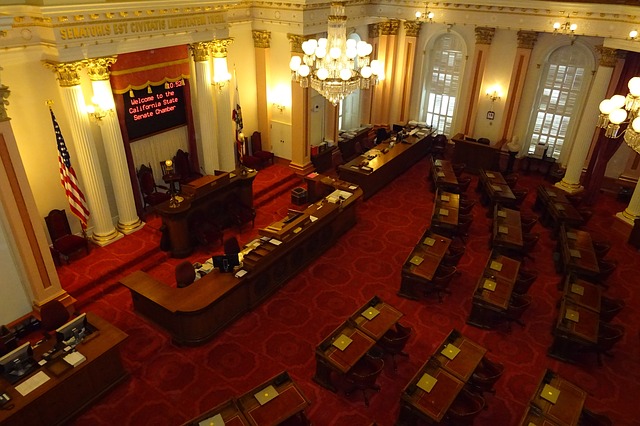

After a break of just a few months, California legislators have now reconvened for the second half of the 2021-2022 Session of the Legislature.

There had been hopes that “we’d be through the pandemic, but it hasn’t gone away,” says Senate President Pro Tem Toni Atkins (D-San Diego). The California Legislature is back: What to expect in 2022 (January 3, 2022, updated January 7, 2022) Sameea Kamal, CalMatters. That means there are certain COVID-19 safety protocols still in place, although hopefully there will not be disruptions as drastic as last year’s periodic recesses.

Last fall, in CA Legislative Wrap-Up: Nonprofits & Charitable Trusts (October 14, 2021), we reported on three of the most important legislative developments for the nonprofit sector. Here, we’ll include some updates and mention a few more that did not make it to the finish line in 2021 but may be taken up this month.

We’ll also discuss, briefly, a new bill introduced in the California Senate in early January 2022 that addresses the alleged involvement of more than a few tax-exempt organizations in the events on and around the January 6, 2021, insurrection at the U.S. Capitol.

An important online resource is the California Legislation Tracker, prepared by the California Association of Nonprofits (“CalNonprofits”) and updated daily. CalNonprofits is actively engaged on behalf of our community with legislators and Sacramento officials. This Tracker includes pending and prospective legislation for 2022. It also has information on items that were presented during 2021, whether signed into law or not. CalNonprofits includes certain legislative proposals that are not necessarily exclusively related to nonprofits, but which more indirectly affect them or their constituencies.

In our October 14th post, we discussed three key legislative accomplishments directly relevant to the nonprofit sector on: (1) AB 488: crowdfunding; (2) AB 900: duties of charitable trustees; and (3) AB 633: emergency powers of nonprofit corporations.

While the emergency-powers statutory amendment is now is effect, the other two items have delayed effective dates along with mandates for the California Attorney General to develop proposed regulations to implement them.

Crowdfunding

In A New Crowdfunding Law – At Last! (September 28, 2021), we discussed Assembly Bill 488 subsequently signed into law on October 5, 2021. The multi-year process of shaping a final workable compromise bill had included special efforts, particularly in the spring and summer of 2021, by Attorney General Rob Bonta, the legislative sponsors, and various stakeholders and interested parties.

Although the effective date was intentionally delayed until January 1, 2023, this new law includes duties and deadlines in early 2022 for the California Attorney General’s office. The statute leaves certain critical details to be worked out through the standard regulatory process which includes drafting and publishing proposed regulations, followed by a public-comment period.

AG Bonta’s team is already at work on this process. They hosted a December public (zoom) forum, inviting input from anyone interested in helping to shape and develop the proposed regulations down to the smallest details. The process for regulation drafting is following the same participatory and inclusive path that had highlighted the negotiations of the final bill.

At the end of the December forum, officials said they expect to have proposed regulations drafted and ready in about February 2022, following which more public participation will be welcomed.

Trustees

AB 900, signed into law on October 8, 2021, is effective on and after July 1, 2022. It tightens up controls on, and reporting duties by, any “trustee holding assets subject to a charitable trust.” The trustee must “give written notice to the Attorney General at least 20 days before the trustee sells, leases, conveys, exchanges, transfers, or otherwise disposes of all or substantially all of the charitable assets.” This bill is significant because “it closes a legal loophole that leaves open the possibility of self-dealing by charitable trustees and will help protect donors from unscrupulous trustees.”

Like the crowdfunding measure, this slightly delayed law also imposes duties on the California Attorney General’s office to “establish rules and regulations necessary to administer this section” beginning on and after January 1, 2022. There will be proposed regulations issued sometime in the next few months which will include the standard public-comment period.

Other New Statutes

AB 1267 (Cunningham), signed into law on September 22, 2021, allows alcohol beverage manufacturers to give to nonprofits a portion of proceeds from their fundraising efforts through sales of alcoholic beverages. Now through 2024 nonprofits can work with alcohol beverage manufacturers to fundraise as long as those efforts do not encourage alcohol consumption.

AB 118 (Kamlager), signed into law on October 8, 2021, creates the Community Response Initiative to Strengthen Emergency Systems Act grant pilot program to provide grants to community-based organizations to engage in emergency response activities that do not require a law enforcement officer.

In 2021 Wrap-Up: Eight New California Laws Impact Nonprofits (October 2021), the California Association of Nonprofits summed up the past and future legislative proceedings: “We are excited to continue our work next year with these bill authors for these two-year bills that we sponsored or supported year, and which will be taken up again in early 2022.”

The NonProfit Times just reported this week on a new bill in the California State Senate that is already the subject of some controversy. See Capitol Insurrection Inspires California NPO Revocation Bill (January 18, 2022) Richard H. Levey.

Senator Scott Wiener (D-San Francisco) introduced Senate Bill (SB) 834 in response to the events of January 6, 2021, at the U.S. Capitol. It would “authorize suspension of tax-exempt status to any nonprofit that ‘[p]romotes, engages in, commits to, supports, or aids in any effort to overturn democratic election results or obstruct the peaceful transfer of power.’” The bill, currently with the Senate Rules Committee, has co-authors including senators Josh Becker (D-Peninsula), Dave Min (D-Irvine) and Josh Newman (D-Fullerton). Supporters in the Assembly include principal co-author Kevin Mullen (D-San Francisco) as well as Buffy Wicks (D-Oakland).

SB 834 was introduced “with summary intent language, with full bill language expected by early- to mid-February.”

This proposed legislation has “raised concerns within the Golden State’s nonprofit community. In an email, CalNonprofits Public Policy Director Lucy Salcido Carter wrote: “While CalNonprofits opposes insurrection, we do have concerns about SB 834 (Wiener) in its current form. We don’t want legitimate freedoms/activities by nonprofits to be curtailed. We recognize that Senator Wiener is aware of the challenges in defining which activities would be covered under this bill. We have connected with Senator Wiener’s office and raised our concerns and hope to engage with his office in further conversations about the bill.”

According to Ms. Carter, the senator and his staff responded that they “are aware of what the senator describes as ‘threading that needle’ to ensure protected activities aren’t affected by the bill, and they are looking forward to working with us to address our concerns.”

Sources including many news outlets reported last year on the alleged involvement, directly or indirectly, of certain tax-exempt organizations – (including 501(c)(3)s as well as numerous 501(c)(4)s) – across the United States with the activities on and around January 6th. There have been discussions, apparently, in Washington governmental and legislative circles – and on social media – about possible investigations or action.

The California Legislative Tracker includes references to additional grants and funding bills that may be of interest to the nonprofit sector and could be acted on this month. See for instance, the listings for Assembly Bill 106, (Salas) the Regions Rise grant program; Senate Bill 74 (Borgeas), the Keep California Working Act which provides $2.6 billion in relief funds for nonprofits and small businesses that have experienced hardship due to COVID-19; and Assembly Bill 151 (Committee on Budget), Relief Grant Programs, a budget trailer bill that provides new rounds of the Small Business Relief Grant Program, including for nonprofit cultural institutions, and creates performing arts and performance venue grant programs.

Pursuant to a statutory deadline, California’s Governor Newsom just published The 2022-23 Governor’s Budget on January 10, 2022. Reflecting another year of massive budget surpluses, it includes proposed spending of $286.4 billion in total state funds. This financial windfall, of course, can be a critical opportunity for the nonprofit community to persuade officials and legislators to direct much-needed monies to our sector.

– Linda J. Rosenthal, J.D., FPLG Information & Research Director